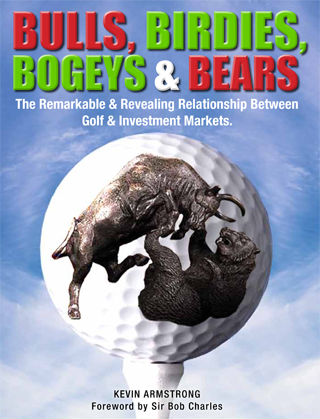

The Remarkable and Revealing Relationship Between Golf & Investment Markets.

The Remarkable and Revealing Relationship Between Golf & Investment Markets.

An entertaining and surprising exploration of the incredibly close interrelationship between golf and investment markets, throughout history and today.

Providing a totally unique perspective on both golf and investing, this book highlights how stock markets have forecast, with an uncanny accuracy, events such as the Ryder Cup and the fortunes of one nation’s golfers over another.

Using the golf/investment relationship the author also explains the ebb and flow, or narrowing and widening, of the “gender gap” in golf, and highlights the incredible parallels between the Global Financial Crisis (GFC) and the rise, fall, and reemergence of Tiger Woods.

This book not only explores and illustrates a number of the manifestations of this incredibly close relationship but goes further and suggests why it exists and what the root cause may be, and provides a framework for prediction. This is essential reading for anyone involved in the investment world with even a passing interest in golf, as it is for all golfers with an interest in investment.

Publication Date: October 1, 2013 (source)

About the Author

Kevin Armstrong is the former chairman of the ANZ Group’s Regional Investment Committee and chief investment officer for their private bank with responsibility for, or oversight of, the investment strategies employed on more than eight billion dollars of assets. Prior to emigrating to New Zealand in 1997, he spent 16 years with Merrill Lynch where he was responsible for the firm’s U.S. institutional equity sales business throughout Europe.

Related posts

Golf Books #227 (501 Excuses for a Bad Golf Shot)

on Tuesday 29, MarchYou can blame your job… You can blame the course… You can blame mother...

Golf Books #145 (The Bogey Man)

on Tuesday 10, JuneWhat happens when a weekend athlete – of average skill at best – joins...

Golf Books #291 (A Good Swing is Hard to Find)

on Tuesday 10, OctoberThrow away those pink golf bags, ladies. And get rid of those tiny golf...